- Super-low premium

- Awesome service

- All in one

-

4.8/5

Blogs

Robotic hoover

Have you had a beautiful PVC floor laid, after a year you have damage from a screw in your robotic hoover.

Basement under water

The rain comes pouring down. Suddenly you hear water running in your basement.... Panic! What to do?

Fence damage

Fence only half insured, while you purchased it yourself in full? That ia not logical right? We thought so too!

What do you need to consider when buying contents insurance?

Your LP collection, your jewellery or a designer sofa. Whatever you have at home, you want it well insured. But what do you actually need to consider when taking out home contents insurance? We have 4 tips for you.

What do you need to pay attention to when you take out car insurance?

Few smells are more satisfying than that of a new car. But before you can actually hit the road, you need to get your car insured. What should you actually look out for before taking out car insurance? 4 handy tips to make sure you don't pay too much premium.

What should you pay attention to when you take out building insurance?

Being busy with insurance. Chances are it is not your hobby. Still, it is useful to know a few things about it. 4 things to look out for when taking out building insurance.

More at home? Time for a financial clean-up

We are all in the same boat (but at least 1.5 metres apart!). Almost all of the Netherlands is sitting at home because of the Corona measures. A good time to take a look at where you stand financially and whether you can make smart savings. For instance, how long has it been since you scrutinised your insurance policies?

How to insure your home for the future

Congratulations. You've bought a house. Whether it's a flat in a big city or a detached farmhouse, you need to insure your new home no matter what. Here's how to future-proof your home.

The Corona virus (COVID-19) and your insurance

On March 15, the government took further measures to contain the further spread of the Corona virus. Of course, we at Deck are keeping a close eye on developments. Read here about issues relevant to your insurance.

De 4 meest lachwekkende vormen van verzekeringsfraude

Insurance fraud is laughably stupid anyway. After all, stealing money from a common pot is heartily anti-social. Yet it can always be more laughable. Here are 4 forms of insurance fraud you normally only see in movies.

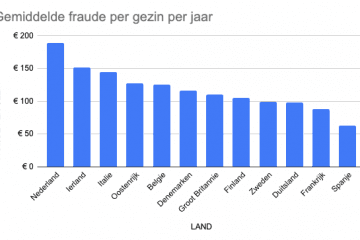

‘Nederland Europees kampioen verzekeringsfraude’

There is no country in Western Europe where more insurance fraud is committed than in the Netherlands. Per household, we pay on average 189 euros too much insurance premium per year as a result. This is according to a study by insurance platform Deck comparing 12 european countries.

Geld besparen: steeds vaker geen noodzaak maar levensstijl

Although the 2007 financial crisis has been behind us for a while now, many Dutch people are looking at how to save money smartly. Not to make ends meet better, but to have more money left over for the nice things in life. Without realising it, there is a lot of waste hidden in your fixed expenses.

4 Redenen waarom alleen verzekeren tegen grote pech #slimverzekeren is

Langlaufende of kortlaufende reisverzekering: Wat is de beste keuze voor je wintersport?

What is the best way to insure your winter sports holiday? Is it more convenient to get short-term winter sports insurance, or are you better off with long-term travel insurance? Spoiler alert: it's the long-term one. Here's why.

Recordaantal verzekeringsfraudeurs in 2018

Nearly 13,000 cases of insurance fraud were detected in 2018. That is 12% more than in 2017. Never before has this number been so high. This saved 82 million euros. This reports the Insurers' Association.

Jongeren de pineut na schade claimen

Young drivers with no or few claim-free years, pay 2x as much premium after a claim as before. This is according to research by Geld.nl. "On top of this, they are stuck with the same insurer for years after the claim due to their negative claim-free years," says Amanda Bulthuis of Geld.nl.

9% meer fraude met verzekeringen in Nederland

There were 9% more reports of insurance fraud in 2018 than in 2017. This is according to figures from Centre for Combating Insurance Crime (CBV). According to the centre, 5,742 reports were received last year.

Wie stapt over naar Deck?

Insurance is not fascinating, it is relevant. You can't do without it. You have to anyway and it involves a lot of money. Do it smarter because it can save you a lot of money. Deck's all-in-one insurance gives you extra benefits and convenience. How we do it? Check Deck:

1.300 frauduleuze claims en aanvragen per dag in Engeland

There are 1,300 fraudulent claims and applications per day in England. This is according to the annual fraud figures from the Association of British Insurers (ABI), the English Association of Insurers. It involves a total of 469,000 cases. This is 3% more than in 2017.

Alles in 1 verzekering van Deck

Deck's all-in-one insurance gives you extra benefits and convenience. Of course, you can search for separate insurance policies all over the internet, but all those separate policies can end up becoming cluttered. Where do you have what running? Where are all those policy sheets? Who should I report claims to? Is my family properly insured? Questions that raise quite a few uncertainties.

Waarom jij meer premie betaalt als iedereen 'verloren' zonnebrillen claimt

The premium you pay to your insurer is used 3 out of 4 times for claims under €1,000. People knock on their insurer's door en masse when their sunglasses or mobile phone breaks. Your insurer needs mountains of staff to process all those claims. That costs a lot of time and money, which can be done differently. We explain to you in 2 minutes what our way of decent insurance entails.

Waar kan ik mijn schadevrije jaren vinden?

When you go to calculate premiums for your new car insurance, you will also always be asked how many claim-free years you have. So how do you know how many claim-free years these are?

Bij Deck ook goed gede(c)kt

Deck insures only the big cases. We don't do relatively small claims, because that creates distractions (and waste) what really matters. We look for people with the same mindset; people who only want to insure what is really necessary. This allows us to offer a very good premium.

Hoeveel ga je terug in schadevrije jaren als je 30 schadevrije jaren hebt?

Answer: If you make a claim with your insurer on your car insurance and you have 30 claim-free years, you fall back to 10 claim-free years. How can that be? The rule is that you only fall back 5 claim-free years after making a claim on your car insurance, right? That's absolutely right. And here's the crux. The maximum number of claim-free years is capped at 15. If you make a claim, insurers calculate with 15 claim-free years and not, in this case, 30. This has been the same with every insurer since 1 January 2016.

Verzekeringsfraude kost jou 100 euro per jaar

Did you know that men commit the most fraud on car insurance and women, on the contrary, on travel insurance? In 2017, €101 million worth of fraud was detected. This is a tip of the iceberg because most fraud is difficult to prove. The burden of proof is often on the insurer. Insurance fraud costs Dutch society an estimated 600 million euros a year, according to the Insurers' Association.

Wat is de kans op schade?

At Deck, we apply the following principle: only insure what you cannot afford to pay for yourself. This is a relative concept. Some people can carry more than others. But what about claims? How often do they occur? And what are the chances of you facing a claim?

Autoschade in Spanje. Wat nu?

Recently, one of our clients had an unfortunate damage in Spain. In a car park, his Spanish neighbour's porter had collided with his car, causing damage to his car door. In the Netherlands, such a damage is fairly easy to settle, but how does something like this work when it happens to you abroad?

Verzekeren voor 'smart ones'

Lost sunglasses, broken mobile phone, wine stain in carpet, felt pen on wall, scratch, dent or pothole? Not at Deck. Deck only insures the big bad luck. 75% of all claims with insurers are under €1,000. That makes insurance complicated and expensive. Deck goes back to the basics as insurance was once intended: only insure what you cannot pay yourself.